|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

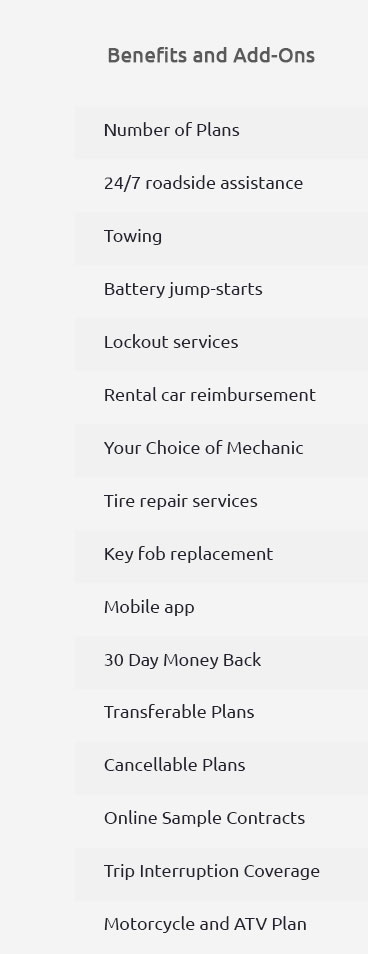

Exploring the Nuances of Superior Protection Plan Reviews: A Comprehensive Guide for BeginnersIn today's rapidly evolving landscape of consumer protection, the concept of a 'superior protection plan' emerges as a beacon of assurance and reliability. As consumers become more discerning and aware, the demand for robust protection plans has skyrocketed. But what exactly makes a protection plan 'superior'? This article delves into the intricate world of superior protection plans, offering a nuanced perspective that is both informative and subtly opinionated, perfect for those new to the topic yet eager to stay well-informed. At the heart of any superior protection plan lies a commitment to providing comprehensive coverage. These plans typically extend beyond the basic offerings of standard warranties, encapsulating a wide array of benefits designed to cater to diverse consumer needs. From extended coverage on high-ticket items to specialized protection for electronic devices, a superior protection plan often encompasses it all. The key here is to understand the specific terms and conditions, which can significantly vary from one provider to another. Understanding the fine print is crucial, as it often hides the true value of the plan. For instance, while some plans may boast of 'unlimited' service calls or repairs, they might impose restrictions on the types of damages covered. It is essential for consumers to meticulously review these details, ensuring that the plan aligns with their expectations and lifestyle. One subtle opinion that often emerges in reviews is the notion of peace of mind. Many consumers express that the true value of a superior protection plan lies not just in the financial savings but in the intangible assurance it provides. Knowing that their valuable assets are safeguarded against unforeseen circumstances allows them to enjoy their purchases without the lingering fear of potential mishaps.

Moreover, a superior protection plan can often be seen as an investment in longevity. By opting for such a plan, consumers essentially extend the lifespan of their purchases, as regular maintenance and timely repairs are covered, preventing small issues from escalating into major problems. This aspect is particularly valuable in today's throwaway culture, where sustainability and mindful consumption are becoming increasingly important. In conclusion, while the initial cost of a superior protection plan might seem like an additional expense, the long-term benefits often outweigh the upfront investment. By offering a safety net that covers a broad spectrum of potential issues, these plans empower consumers to make informed decisions, ensuring that they can enjoy their purchases to the fullest without the constant worry of unexpected costs. As with any financial decision, due diligence is key. Prospective buyers should thoroughly research and compare different plans, taking into account factors such as coverage scope, provider reputation, and customer reviews, to find the plan that best suits their individual needs. In an era where consumer protection is paramount, superior protection plans stand out as a testament to the evolving nature of customer service and product assurance. As more people become aware of their benefits, the landscape of consumer protection is set to transform, offering enhanced peace of mind and security for all. https://www.bbb.org/us/az/tucson/profile/security/superior-protection-services-1286-20109265

Not BBB Accredited. Security in Tucson, AZ. See BBB rating, reviews, complaints, and more. https://www.tiktok.com/discover/is-superior-protection-plan-a-good-car-warranty

Everything else is 100% covered. and I just love that piece of mind. Especially if you're not into fixing cars. You don't know a lot about cars. You know ... https://www.indeed.com/cmp/Superior-Protection-Services/reviews?fcountry=ALL&ftext=company

Management will LIE to you to avoid offering you hours nor reducing your hours! HR fires for no reason, and management blames officers for ...

|